"Banks might normally be leveraged 10:1, so some of the logic is that if you invest a billion dollars in a bank in capital, then over a period of time that bank may create $10 billion in loans," explains Mike Menzies, CEO of Easton Bank and Trust.

But, it hasn't quite worked out that way. It turns out that most of the banks have been sitting on the bailout money instead of making new loans. There are signs indicating that the real balance sheets of the banks are much worse than what's already known by the public. So, the banks are holding the bailout money as their own safety net rather than taking new risks. Neither the Treasury Department nor the congress has any means for the banks to provide accounting records about their received bailout money. So far, the $350 billion bailout is as good as throwing a stone into the ocean.

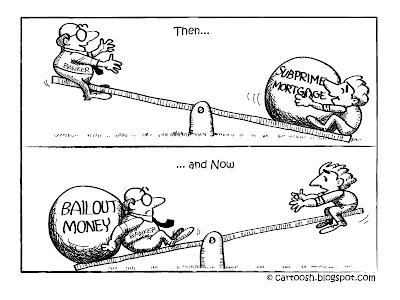

Also, see this editorial cartoon on CNN's iReport.com.

(Click to see the full sized picture.)

No comments:

Post a Comment